Des Moines, Iowa. March 21, 2018- Wink’s Sales & Market Report, the insurance industry’s #1 resource for indexed annuity sales data since 1997, is in its third year of reporting on all non-variable deferred annuities which include indexed annuity, traditional fixed annuity, and multi-year guaranteed annuity (MYGA) product lines.

Fifty-eight indexed annuity providers, 52 fixed annuity providers, and 60 MYGA companies participated in the 82nd edition of Wink’s Sales & Market Report for 4th Quarter, 2017. Total fourth quarter non-variable deferred annuity sales were over $21.1 billion; up 4.2% when compared to the previous quarter and up 0.5% when compared to the same period last year. Total non-variable deferred annuity sales for 2017 were $87.9 billion, a decline of 9.1% from the prior year.

Noteworthy highlights for all non-variable deferred annuities in the fourth quarter included AIG ranking as the #1 carrier overall for non-variable deferred annuity sales, with a market share of 8.5%. Allianz Life moved-into the second position and American Equity Companies, Global Atlantic Financial Group, and New York Life rounded-out the top five carriers in the market, respectively. Allianz Life’s Allianz 222 Annuity, an indexed annuity, was the #1 selling non-variable deferred annuity, for all channels combined, in overall sales.

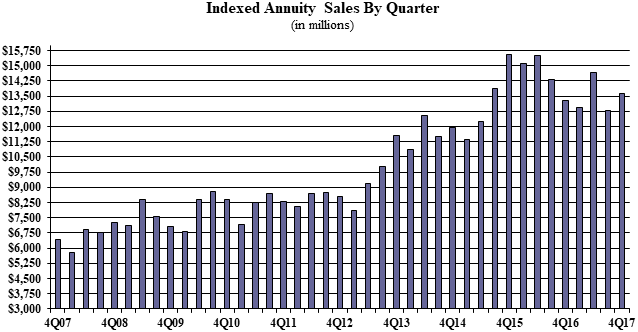

Indexed annuity sales for the fourth quarter were $13.6 billion; up 6.4% when compared to the previous quarter, and up 2.3% when compared with the same period last year. Annual indexed annuity sales for 2017 were $53.9 billion, a decline of 7.1%. Total indexed annuity sales for 2017 were $53.9 billion, a decline of 7.1% from the year prior.

“This is the first time that annual sales of indexed annuity sales have declined in a decade,” proclaimed Sheryl J. Moore, president and CEO of both Moore Market Intelligence and Wink, Inc. She continued, “While early projections of 35% sales declines were amusing, I would hardly say that a 7% loss in sales is an unmanageable hurdle, given the challenges the DOL’s rule had presented.”

Noteworthy highlights for indexed annuities in the fourth quarter included Allianz Life retaining their #1 ranking in indexed annuities, with a market share of 12.3%. Athene USA took-over the second-ranked position, and Nationwide, American Equity Companies, and AIG rounded-out the top five carriers in the market, respectively. Allianz Life’s Allianz 222 Annuity was the #1 selling indexed annuity, for all channels combined, for the fourteenth consecutive quarter.

Traditional fixed annuity sales in the fourth quarter were $755.0 million; down 4.8% when compared to the previous quarter, and down 27.1% when compared with the same period last year. Total traditional fixed annuity sales for 2017 were $3.6 billion, a decline of 28.6%. Traditional fixed annuities have a one-year guaranteed fixed rate.

Noteworthy highlights for traditional fixed annuities in the fourth quarter include Jackson National Life ranking as the #1 carrier in fixed annuities, with a market share of 17.1%. Modern Woodmen of America continued in the second-ranked position and Global Atlantic Financial Group, Great American Insurance Group, and EquiTrust rounded-out the top five carriers in the market, respectively. Forethought Life’s ForeCare Fixed Annuity was the #1 selling fixed annuity for the quarter, for all channels combined.

Multi-year guaranteed annuity sales in the fourth quarter were $6.7 billion; up 1.2% when compared to the previous quarter, and up 1.3% when compared to the same period last year. Total MYGA sales for 2017 were $30.3 billion, a decline of 9.5%. A MYGA has a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the fourth quarter include New York Life ranking as the #1 carrier in MYG annuity sales, with a market share of 19.7%. AIG moved-into the second-ranked position, while Global Atlantic Financial Group, Massachusetts Mutual Life Companies, and Security Benefit Life rounded-out the top five carriers in the market, respectively. Forethought’s SecureFore 3 Fixed Annuity was the #1 selling multi-year guaranteed annuity for the quarter, for all channels combined.

“Although the DOL’s fiduciary rule is in the rearview mirror, some form of fiduciary standard is likely here to stay,” opined Moore. She continued, “The good news is that annuity sales won’t likely be dramatically affected by this in 2018, as distribution has already been adapting their products, processes, procedures, forms, and more.”

While Wink currently reports on indexed annuity, fixed annuity, and multi-year guaranteed annuity product sales, the firm looks forward to reporting on immediate annuity and variable annuity product sales in the future. Wink will begin this process by requesting sales of indexed variable annuities (a.k.a. structured variable annuities, collared variable annuities, and buffered variable annuities) beginning first quarter, 2018.

The post Indexed Annuity Sales See First Year-Over-Year Drop In Decade appeared first on InsuranceNewsNet.

0 Response to " Indexed Annuity Sales See First Year-Over-Year Drop In Decade "

Post a Comment